As the disparity between wages and house prices continues to grow further apart, those most affected are first time buyers. Generation Y (those born in the 80s and 90s) are the largest group to feel the impact of recent property price hikes and as a result, the UK rental market has seen a sharp incline too. Renting is the only affordable way to achieve independence for many moving out of the family home, therefore the property market has created a vicious cycle; it is impossible to rent and save for a house at the same time. The alternative? Living at home until you're 35 and saving like your life depends on it. Win!

At Safestore we have noticed an increase in parents using self storage, especially in our inner city and

London stores, as households are accommodating parents and their adult children who, naturally, accumulate more belongings than children.

Advice from peers

In our search for useful advice aimed at hopeful first time buyers we thought it would be interesting to hear from other young people who have achieved the Holy Grail of home ownership. But after a lengthy search it seems that finding genuinely helpful guidance is almost impossible.

To give a prime example, the BBC recently wrote an article entitled "

How to own a home by the age of 25" and whilst the headline masquerades as helpful advice, the tips are wholly underwhelming. To summarise the information:

1. They interviewed

couples aged 22-25. No one interviewed had purchased their first house as a solo investment.

2. The couples interviewed all lived miles outside of London. 70 miles minimum, in fact.

3. The advice given by each couple was simple - don't go out socialising and don't even

think about buying yourself luxuries. Essentially, don't spend any money you earn on pleasantries because you need to save every penny.

The issue with this advice is that young people are being forced into financial situations that may be best avoided. Firstly, investing in a property with a boyfriend or girlfriend in your early 20s is a frightening concept for many, but serves to prove that without a partner the chances of owning a home are slim.

Secondly, the advice is not helpful for anyone who lives near London. Those within a 50 mile radius of London will have a significantly harder time finding affordable properties and even when they do, getting an offer in before it's snapped up by property developers or buy-to-let agents is excrutiatingly difficult.

What's the solution?

Unfortunately the possibility of young adults affording their own homes without a bit of help is becoming increasingly rare. Many parents are now looking for ways to help their children and it needn't bankrupt the family. All it takes is some careful planning and consideration; just follow these simple tips...

1. Contribute to their savings

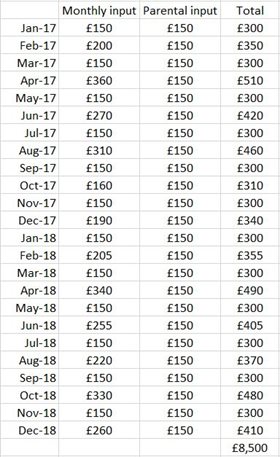

Coming up with a long term saving plan is a great way to help your children on their way to getting a deposit together. Better still, if you can contribute to (or even match) their savings each month they will achieve their goal in half the time! Start with a simple spreadsheet and calculate how much they'll need to save a month in order to hit their target. Moreover, encourage flexible savings whereby your child saves as much as they can but sets a minimum amount per month to keep things on track!

2. Joint mortgages

2. Joint mortgages

As parents you can add your names to the title deeds and mortgage documents and share ownership of the property. This means that your income will be taken into consideration and will boost the potential loan value. The only downside of this arrangement is that it involves second home ownership for you as a parent meaning there is a potential Capital Gains Tax issue to consider.

It can, however, be reduced if parent and child hold the property as 'tenants in common'. This means each owning an apportioned percentage of the whole, which could be very small for the parent, rather than as 'joint tenants' who both own the whole property.

3. Act as a Guarantor

Another option is to act as guarantor on the mortgage; this means you accept responsibility for the loan in the event that your child can't meet repayments. Similar to a joint mortgage, the mortgage lender takes into account your income, debts and/or assets, as well as your child's income, when it comes to assessing how big a loan to approve.

4. Family Deposit Mortgages

Family Deposit Mortages require a 5% deposit from your child and you, as the parent, put a further 20% deposit into a separate interest-earning account. This is for a set period (typically five years) and acts as collateral. As a result your child is able to access a more competitive rate and the best part of this arrangement is that the 20% is not a gift, nor is it tied into the property itself. In simple terms, so long as all repayments are met, the 20% parental deposit is returned at the end of the five year period!

Legal consultation

As with any financial agreement it is very important to consult a solicitor and seek professional advice regarding mortgages and money lending. Although helping children onto the property ladder is becoming more popular it is important for parents to ensure the agreement works for everyone involved and does not bankrupt either party.

If you have any further suggestions to add to this list, or an experience of your own you'd like to share, leave us a comment below.

*****

Discover more

how to articles on Safestore’s

blog where you’ll find a range of topics; from home improvement ideas to innovative storage tips and more. Or, if you’re looking to create more space at home we have a range of self storage options in over 100 locations – find your

nearest store for a quote today.