Task Force on Climate-related Financial Disclosures (“TCFD”)

Since 2021, we have been on a journey to implement the relevant recommendations of the TCFD, providing our stakeholders and investors with insight into the key climate-related risks and opportunities that are relevant to our business and how these are identified and managed. We report against the eleven recommendations of the TCFD in this year’s disclosures.

Governance

Our Chief Executive Officer has overall responsibility for climate-related risks and opportunities. Day-to-day management of climate-related issues is carried out by our sustainability group which is co-chaired by three members of the Executive Management Team (see sustainability governance section for organisation structure). The Group meets quarterly and is the forum for determining our sustainability strategy, reviewing performance, identifying emerging sustainability issues, and determining their materiality for reporting and escalation via the Group risk management process.

The Board oversees climate-related risk via the Group risk management process. The Board takes climate issues into consideration during the investment appraisal process, where it scrutinises major investments including acquisition, development, and refurbishment plans which may include climate-related aspects of design. Ongoing risk identification and management are through the relevant functional teams, for example through proposed or actual responses to changes in regulation such as the Minimum Energy Efficiency Standards (“MEES”) in the UK.

Our commitment to address climate-related risks is embedded across the Group through a carbon intensity KPI. The performance against this measure is linked to executive remuneration, aiming to incentivise progress against carbon emissions reduction targets. The Board reviews progress on carbon reduction alongside other strategic initiatives annually as part of the annual targets and remuneration cycle.

Risk management

The Sustainability Group is responsible for identifying general climate-related risks that are managed by the Board via our corporate risk management process (see the Audit Committee report for details of our approach to risk management). In addition, the Property function is responsible for identifying risks specific to new development projects as part of the investment appraisal process. The Sustainability Group has conducted workshops incorporating inputs from internal and external experts and climate model data to explore the relevance and potential financial impact of the six risk themes identified in the TCFD framework over the short (to 2030), medium (to 2050), and long (beyond 2050) term.

These themes remain under review, particularly the physical risks to the Group portfolio as we expand into new markets, climate models evolve, and governments and municipal authorities develop their own mitigation strategies.

The completed climate-related risk register is reviewed and approved by the Audit Committee during the financial year such that the significance of climate-related risks is considered in relation to risks identified in the standard risk management process. This ensures the management of climate-related risks is integrated into the Group’s overall risk management framework. The climate-related register is reviewed annually to incorporate ongoing refinement and quantification of risks and to ensure the register reflects any material changes in the operating environment and business strategy. Once identified, further details related to each key risk and opportunity, such as a quantification of the financial impact, the appropriate strategic response and cost of response and the variance of key risks in relation to climate-related scenarios, are developed where possible. These details help to determine the materiality of each risk and, alongside the impact assessment outlined above, this allows the Group to prioritise resources in managing the most material climate-related impacts, determine the best management response or highlight areas requiring further investigation.

An example of day-to-day management of risks would be the incorporation of mitigations for high exposure sites into construction designs before submission for planning approval.

Strategy

Our business is exposed to both risk and opportunity from climate change primarily as a consequence of owning and operating real estate assets in the UK and Western Europe. We seek to understand and mitigate the physical and financial risks that could be material to the business. We have considered several climate hazards (wildfire, extreme heat, water stress, coastal flooding, fluvial flooding, drought) and their relevance to the context of our business. Of these, flooding risk was assessed as the only relevant risk for the UK, which accounts for most of the Group property portfolio by value and floor area. These findings can likely be generalised for Northern European markets, which will experience similar physical consequences. Whilst our Spanish assets may experience different physical hazards, they currently represent less than 3% of the Group by asset value and floor area and have therefore not been considered separately.

Climate-related risks and opportunities are assessed over multiple time horizons because we expect that transitional risks are likely to be ’front-loaded’ as the international community attempts to meet the goal of keeping warming to 1.5°C or below. Physical risks to our assets are likely to increase over time, particularly if the global economy does not decarbonise at the rate required to keep warming below the target level. Accordingly, we assess climate-related risks and opportunities over the short (to 2028), medium (to 2050), and long (beyond 2050) terms. In keeping with the Group’s approach to risk management materiality, risks were deemed to be low impact where the potential annual EBITDA impact is estimated to be below £100k and/or balance sheet impact is below £10 million. High impact is where either the potential EBITDA impact is greater than £1 million or a balance sheet (valuation) impact would exceed £25 million (approximately 1% of property valuation). EBITDA consequence of between £150 thousand and £1 million or likely balance sheet impairment between £10 million and £25 million was considered medium impact.

The assessment of the resilience of the business, specifically the asset portfolio, was guided by a range of scenarios published by external agencies, such as the UK Met Office UKCP18, and looked at both physical and transitional risks under two climate warming scenarios: one within 1.5 to 2.0°C (RCP 2.6); and one up to 4.0°C (RCP 8.5).

| Risk type |

Description |

Potential impact |

Timeframe |

Mitigation/ resilience measures |

| Physical risks |

|

|

|

|

| Chronic |

Physical disruption as a result of longer term shifts in climate patterns (e.g. sustained higher temperatures or rainfall) that may cause sea level rise or chronic heat waves. Intensity of weather (acute risk below) is deemed more significant for the business. |

Low |

Medium–long |

| Acute |

Primarily, flooding risks (northern Europe markets) triggered by changes in the frequency of extreme rainfall events (based on mm/day thresholds), which are projected to increase in all warming scenarios, especially in summer and late autumn. Costs that may be incurred for the few stores exposed include mitigation CAPEX, operational disruption, physical repairs, clean-up, insurance premia increases, and reduced customer demand as a result of reputational damage. |

Medium |

Medium–long |

Avoid high risk exposure areas. Where a store is exposed use appropriate mitigation solutions for the context (e.g., enhanced drainage, flood barriers, water pumps)

As a last resort, relocate to nearby lower exposure site |

| Transition risks |

|

|

|

|

| Policy and legal |

|

|

|

|

| Regulation relating to stricter environmental standards |

Increased stringency of building and planning requirements in support of national net zero targets. Local authorities will seek to use planning systems to deliver progress against climate goals which will impact on build specification and associated costs. MEES standards also increasing for commercial lettings (office locations only) which will drive upgrade expenditure. |

Medium |

Short |

Engage planning authorities to ensure specifications for new stores are proportionate given intended use;

Identify existing locations exposed to regulatory changes - relocate or change use (remove offices) if improvements unviable |

| Climate change litigation |

Claims brought by stakeholders (e.g. investors and public interest organisations) perhaps due to failure to mitigate impacts of climate change, failure to adapt, or the insufficiency of disclosure around material financial risks. |

Low |

Medium |

- |

| Reporting obligations |

Additional reporting burden on carbon emissions, including Scope 3. |

Low |

Short |

- |

| Technology |

|

|

|

|

| Electric vehicles |

To deliver net zero targets, electric vehicle use will increase and drive demand for charging point infrastructure for customers and colleagues. May be mandated by some local authorities as part of planning process. This will impact capital budgets for new builds and retrofits. However, this could also be a revenue opportunity in high traffic locations with an appropriate commercial arrangement |

Low |

Short |

- |

| Market |

|

|

|

|

| Valuation of properties with lower efficiency rating |

Risk of valuation impairment of assets with low efficiency ratings. Only heated areas of storage facilities are rated – these can usually be cost-effectively improved. |

Low |

Medium |

- |

| Supply chain resilience/ cost of materials |

Risk to development costs due to demand versus supply of key materials such as insulation and cost of inputs which may incur carbon premium (steel and cement). |

Medium |

Short-medium |

Seek to convert existing structures where possible/ available. Ensure competitive tendering on major projects |

| Cost and availability of capital |

Risk of downgrading/cost premium as ESG considerations are incorporated into credit ratings and other lender/investor screening. |

Low |

Short |

- |

| Reputation |

|

|

|

|

| Stakeholder risk |

Increasing public awareness of and appetite to tackle climate change could create reputational risk if there is failure to reduce operational and embodied carbon. This could manifest in delays to planning processes.

|

Low |

Short-medium |

- |

| Employee risk |

As colleagues become increasingly engaged with climate change issues, perceived failure to make progress on decarbonisation could impact talent recruitment and retention. |

Low |

Short-medium |

- |

In summary, we expect physical climate-related risks to have some localised impacts on our business. Specifically, the impact of more frequent intense precipitation events is deemed relevant in the medium to long term for a subset of exposed stores. We also expect the transition to a low-carbon economy to pose some limited financial risks in the short term as we respond to changes in regulation and incur costs associated with decarbonising our building development and operations. However, there may also be opportunities that arise from the transition, as well as the physical impacts of extreme weather.

Regardless of the scenario, we believe the Group’s business model and strategy are likely to be resilient as its assets have overall limited exposure and vulnerability to climate-related risk. Accordingly, there are limited ongoing financial implications beyond the cost of meeting higher building standards and introduction of mitigation measures.

The Group will, therefore, continue to grow its portfolio, assessing each investment for climate risk in addition to financial considerations and making necessary physical and financial allowances for mitigations where appropriate, as it already does today.

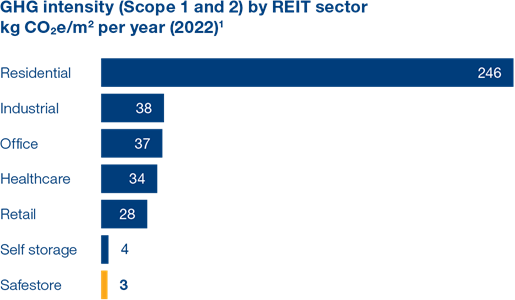

The self storage sector is not a significant consumer of energy when compared with other segments of the real estate landscape. According to a 2023 report by KPMG and EPRA

1, self storage generates the lowest greenhouse gas emissions intensity of all European real estate sub-sectors. Reflecting the considerable progress made on efficiency measures and waste reduction to date, Safestore’s emissions intensity is considerably lower than the self storage sector average.

| Nevertheless, as part of our commitment to SDG 13 (Climate action) we have been working towards a previously set near term carbon reduction target to 2025 (see sustainability targets and KPIs). In addition, we have a commitment to work towards operational net zero by 2035. This commitment covers Scope 1 and 2 emissions plus Scope 3 emissions which relate to ongoing operations (water, waste, electricity transmission and distribution and business travel). This year, we have introduced an interim target for absolute emissions and emissions intensity for the financial year ending 2028 as a milestone on our journey to operational net zero (see sustainability targets and KPIs). |

|

|

Physical risks

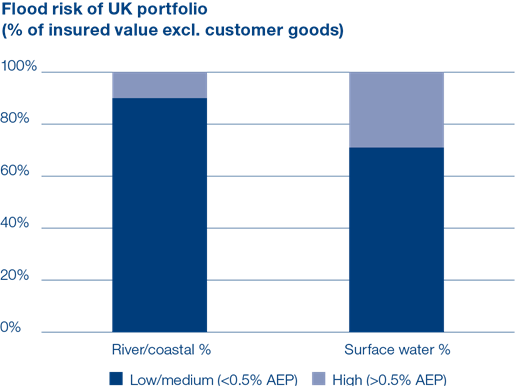

The primary physical risk to our business relates to the increasing likelihood of extreme weather events (particularly intense precipitation and flooding). Based on current data, our insurer’s flood assessment at the last renewal indicates that 91% of the Safestore portfolio by floor area (90% by insured value) has little to no exposure to river/coastal flood risk (the chance of a flooding event occurring annually is less than 0.5%). This corresponds to just twelve current locations in the UK with an elevated risk. There is a slightly higher exposure to surface water flood risk – 71% of floor area and value is in stores with less than 0.5% Annual Exceedance Probability.

| Accordingly, overall the portfolio has low exposure to acute flooding risk, and whilst the frequency of extreme precipitation events are projected to increase in all warming scenarios, the number of medium and high impact rainfall days (defined by the UK Met Office’s National Severe Weather Warning Service as 24-hour precipitation thresholds in mm/day which are designed to be used for identifying prolonged rainfall which may lead to flooding) are still projected to be relatively rare events2. |

|

|

Research using the most recent granular climate models

3 confirms this projection of extreme rainfall events and demonstrates the elevated risks are in the autumn and summer seasons specifically. Spring and winter events are rarely projected to exceed any impact threshold out to 2080, even in the low mitigation (RCP 8.5) scenario. This pattern is expected to be similar across the UK. This research implies that the probability of these extreme events will rise in autumn by 5–10% by 2040 and by 20–40% by 2080. The summer season shows the largest change, especially towards the end of the century, with probability close to 50% higher for a 1-in-200 year event, i.e. despite overall summer drying trends in the future, increases in the intensity of summer rainfall events are projected. It should be noted, however, that projections for rare events have a high degree of uncertainty, especially in the outer years of a projection period.

From prior experience, the main consequences of these intense precipitation events are clean-up, repairs and maintenance costs, and short term impact on asset availability (temporary closures preventing new move-ins). Costs are usually recovered from insurers so over time it is reasonable to expect insurance premia and flood-related excesses will increase if extreme events occur more frequently. There is also the longer term risk of lower occupancies in exposed stores – although customer goods are also insured to their declared value, there is the possibility of a reputational impact. A reasonable assumption for the cost based on prior experience (borne by insurers, direct impact being the impact on cost and availability of insurance) of remediation after an extreme precipitation event is £100k per event, regardless of the warming scenario.

Projections of low, medium, and high impact rainfall days in the UK per year under different warming scenarios3

It should be noted that where Safestore invests in property in higher risk areas, risk mitigation measures are usually proactively deployed. As such, even in extreme weather scenarios the majority of the UK portfolio is not likely to be impacted from an ongoing operation, insurance risk premium or valuation basis. Mitigation measures (where deployed) should minimise disruption at higher risk sites, and these locations may, in fact, experience increased demand from impacted local communities as they seek temporary storage for their belongings. In locations where mitigation becomes unviable, or cost/ availability of insurance becomes prohibitive the Group would seek to relocate to a nearby less exposed site.

Transitional risks

Our primary transition risks are policy and regulatory changes, which may increase building specifications to meet net zero objectives. Local authorities will continue to use planning processes to deliver against their own objectives and policies such as Minimum Energy Efficiency Standards (“MEES”) will impact landlords in the residential and commercial sectors. To ensure relevant UK assets meet MEES minimum standards, an estimated capital investment of approximately £650 thousand will be required which will be incorporated into our annual capital expenditure plans. For more details, see page 66. Should any of our facilities with offices be unable to cost-effectively meet MEES standards, we would convert office space into storage area, which does not have this requirement meaning there is minimal risk of lost revenue or ‘stranding’ of assets.

Requirements for new projects to meet more stringent energy efficiency standards and include features such as solar photovoltaic panels and electric vehicle charging facilities will add to the capital costs of new developments; however, these would represent a small portion (1–2%) of a new development project and would likely be recovered through lower ongoing operating costs over the lifetime of the building. A related market risk of carbon taxes on core building materials such as steel could have a larger impact; however, where possible, Safestore will convert existing structures and is, therefore, less exposed to these increases in cost and embodied carbon.

Our transition plan is a combination of operational improvements, including consumption reduction initiatives such as phasing out of gas heating in the portfolio and ensuring all energy consumed is self-generated (where viable) or purchased from certified renewable sources. New buildings introduced to the portfolio will be developed to high energy efficiency standards. Some residual emissions may require the purchase of carbon offsets from a credible scheme(s). We estimate that the roadmap to operational net zero will require a total investment of c. £3 million to 2035, with investments in later years subject to detailed business case evaluation.

Opportunities

The transition to a low-carbon economy is likely to present opportunities as well as risks. In general, businesses that build and operate sustainable facilities are well-positioned in a world where both local planning departments and end consumers are making decisions with climate change in mind. In addition, reducing the energy intensity of the business and reliance on gas is financially advantageous, particularly in an era of volatile energy prices. Removing gas-burning appliances from facilities also reduces associated fire and carbon monoxide exposure risk. However, it should be noted that the business is not an intensive user of energy (energy costs were 1.5% of revenue in 2022), unlike other more intensive usage sectors, so the variability of power prices is not considered a significant risk or opportunity. Nevertheless, it is likely that buildings with lower operating costs and carbon emissions intensity will attract a valuation premium and lower cost of funding over the medium to longer term. Assuming PV installations progress, and grid connections are made, and a suitable trading mechanism emerges, sales of excess power generated from rooftop solar installations could become a revenue stream in the medium term in addition to supporting decarbonisation in our communities and the wider economy.

The provision of electric vehicle charging facilities could deliver a customer benefit in the short term whilst also reducing associated Scope 1 (business travel) and Scope 3 (customer travel to/from stores) emissions and provide another ancillary revenue stream.

It should also be noted that well-positioned self storage facilities could be seen as adding ’system resilience’ to supply chain disruptions and facilitating recovery post-extreme weather events via temporary storage of business or consumer goods. This would be of more relevance in the longer term as chance of extreme weather events increases.

Metrics and targets

To assess climate risk, we internally record and monitor a range of construction and operational impact metrics such as development cost trends, unit availability (offline units) and damage claims relating to water damage. We also track and disclose the floor risk exposure of the UK property portfolio (see section on physical risks).

In addition, we monitor and report a range of metrics relevant to the property sector per the EPRA sBPR recommendations. Specifically, we disclose:

- energy consumption (gas and electricity) and building energy intensity per unit floor area

- water use and water use intensity

- waste generation including the proportion diverted to landfill

- Scope 1 and 2, and operational Scope 3 greenhouse gas emissions and emissions intensity

- Energy performance ratings (EPC or equivalent) of new store developments

These are disclosed in the Our Environment section. Specifically, Scope 1, 2 and 3 emissions are disclosed in the mandatory greenhouse gas reporting and Streamlined Energy and Carbon Report.

Supplementary data can be found in the Sustainability section of our website, including the basis of reporting and independent limited assurance on selected metrics. Scope 3 emissions which relate to ongoing operations (water, waste, electricity transmission and distribution and business travel) are measured and actively managed. Upstream Scope 3 emissions relating to purchased goods and capital expenditure are not currently reported, but we are actively engaging with our suppliers to ensure these are being considered, for example, through consolidation of deliveries to our stores or the proportion of recycled material used in development projects. Downstream Scope 3 emissions (primarily customer journeys to our stores) are likely to be material; however, we are not currently able to measure or report these. We contend that collecting and reporting this data would not be an appropriate use of time or resources given that emissions will naturally abate over time as the consumer vehicle fleet and electricity grid decarbonise in each of our markets.

Strategy for operational net zero

We will achieve operational net zero by 2035, through:

| a) Reducing and optimising what we use |

|

b) Using only zero carbon energy |

- Completion of lighting efficiency programme (external signage and customer unit lighting)

- Voltage optimisation at selected sites

- Decommissioning of gas appliances

- Installation of building management

- Systems for remote monitoring and power management (business case dependent)

|

|

- Installation of solar photovoltaic on new-build stores where viable

- Securing certificated green electricity through PPAs and/or ‘high quality’ tariffs

- Transition of company car fleet to PHEVs* and BEVs* and introducing charging points

- Retrofit of rooftop solar photovoltaic to selected stores (business case dependent)

|

Total investment of c.£3m spread until 2035

* PHEV = Plug-in Hybrid Electric Vehicles; BEV = Battery Electric Vehicles.

Notes:

1HKPMG/EPRA: Overview of real estate companies’ environmental performance, October 2021 (based on EPRA sBPR data sets for 88 listed companies).

2Hanlon, H.M., Bernie, D., Carigi, G. et al. Future changes to high impact weather in the UK. Climatic Change 166, 50 (2021). https://doi.org/10.1007/s10584-021-03100-5)..

3Shane O’Neill, Simon F.B. Tett, Kate Donovan. Extreme rainfall risk and climate change impact assessment for Edinburgh World Heritage sites, Weather and Climate Extremes, Volume 38, 2022.