Why Renting Can Be a Positive Experience

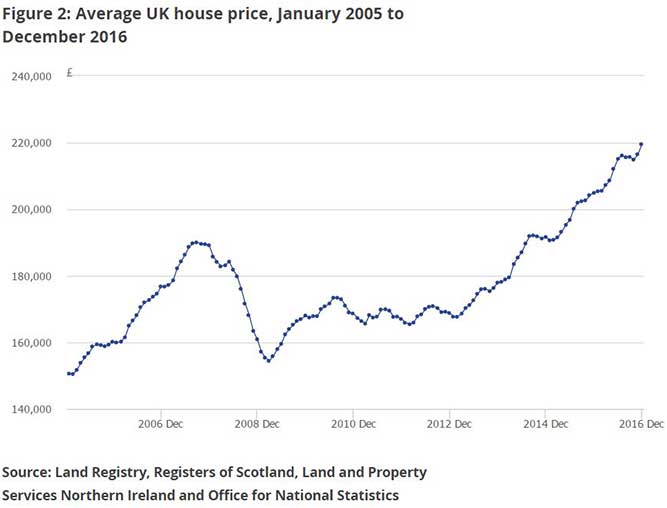

As property prices increase year on year, the hunt for affordable housing is set to become more difficult. Between December 2015 to 2016 prices in the UK increased by 7.2% and the average house price rose to £220,000 - £15,000 more than in the previous year.

As property prices increase year on year, the hunt for affordable housing is set to become more difficult. Between December 2015 to 2016 prices in the UK increased by 7.2% and the average house price rose to £220,000 - £15,000 more than in the previous year.

Image source: Office for National Statistics

London continues to be the UK's most expensive region; the average house price is £484,000 followed by the South East where average prices come in at £316,000. Therefore to live in, or near, the city is a huge expense and an expense that doesn't look set to slow down for some time.

How times have changed

Buying a house hasn't always been this difficult. In the 80s the average national wage was just over £16,000 and the average house price was £44,142. The average house price was therefore only 2.7x the average income. Compare that to the past decade and it's an entirely different story.

In 2016, the average salary across the UK was £27,000 and, as mentioned, house prices were £220,000 on average. House prices have therefore risen to over 8x the average annual salary, making the dream of owning a home much harder to achieve*.

Many young people born in the 90s have little hope of purchasing their first home without help from their parents therefore renting is on the rise. The Telegraph believe that by 2025 only 40% of those living in London will own their own home - a total reverse compared to 2000 when 60% of Londoners owned their own properties.

Image source: The Telegraph

The pros of renting

In such a bleak property market it's important to remind ourselves of the benefits of renting. Whilst many see it as throwing money into a black hole, renting has its merits!

- Renting allows you to move and relocate as and when you need to. If your job moves around a lot or you like the freedom to up-sticks when you need to, renting is a great choice.

- As a tenant you are not responsible for property taxes, maintenance or repairs which can be costly. These costs are covered by your landlord.

- You can downsize (or upscale) the size of the property you live in depending on what you're earning - a mortgage, on the other hand, is fixed.

- As a tenant you may be able to rent a property in an area that you could not afford to buy in.

- You can invest your money in a number of ways whether it's saving to buy a house or in stocks and shares; you're not tied into putting all of your funds towards your mortgage.

- As property prices increase, so do mortgage repayments. The monthly cost of renting is equal to, if not less, than mortgage repayments in many areas.

*****

Discover more moving home articles on Safestore’s blog where you’ll find a range of topics; from homeowner advice to expat tips and more. Or, if you require storage during a move we have a range of self storage options in over 100 nationwide locations and 40 if you're looking for London Self Storage – find your nearest store for a quote today.

* Data taken from the following sources:Discover more moving home articles on Safestore’s blog where you’ll find a range of topics; from homeowner advice to expat tips and more. Or, if you require storage during a move we have a range of self storage options in over 100 nationwide locations and 40 if you're looking for London Self Storage – find your nearest store for a quote today.

www.gov.uk/government/statistics/

www.housepricecrash.co.uk/indices-nationwide-national-inflation.php Renting has its pros