How the Stamp Duty Changes will affect you

"Frankly, people buying a home to let should not be squeezing out families who can't afford a home to buy." George Osborne

On the first of April this year we are going to see some changes to Stamp Duty, the additional charge paid to the government when we purchase a house, both in England and Scotland. Those that own more than one property (e.g Buy-to-Let) will see their stamp duty go up considerably and those looking to buy a single property (e.g. first time buyers) will see a reduction in their stamp duty.

If you own a single property

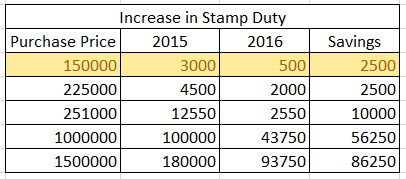

It’s a complicated matter so we will attempt to break it down. In the past, we paid a certain percentage depending on the value of the house. Using the figures below, if you purchased a home for £150,000 you would pay a flat rate of 2% which would mean you would have to pay £3000 in Stamp Duty to the government.

- Up to £125,000 - 0%.

- Over £125,000 to £250,000 - 2%.

- Over £250,000 to £925,000 - 5%.

- Over £925,000 to £1,500,000 - 10%.

- Over £1,500,000 - 12%

This flat rate scale is being replaced by a sliding scale which is more in proportion to the value of the property, but uses the same bandings. So, if you purchased a house in 2016 for the same amount of £150,000 you would not pay anything on the first £125,000 but you would owe 2% on the portion above the £125000, which is £25000 resulting in a Stamp Duty bill of £500, meaning a savings of £2500 which is encouraging to first time buyers. See table below for potential savings for one property owners.

If you have more than one property

The biggest change is to those that own more than one property; whether it’s a landlord building a portfolio of rentals, developers buying to renovate and sell, families investing in a holiday homes, two property owners moving in together or parents trying to help their kids get on the property ladder.

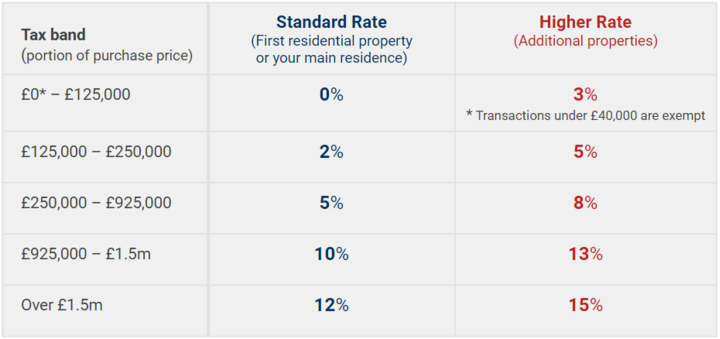

If you have more than one property you will be subjected to an additional surcharge of 3% for each of the bands. This will also affect those who purchase a new home but are yet to sell the old one. However, if you sell it within 18 months you will get a rebate.

Courtesy of Your Wealth

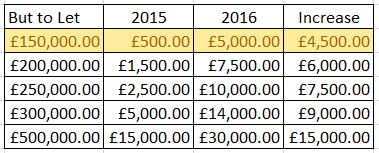

As you can see using the tables above, buying a second home in 2016 will result in a sharp increase in Stamp Duty, if you own one house (£150,000) your Stamp Duty will be £500 but if it’s your second home it will rise to £5000.00.

Are you buying a house this year? How will this affect you? We’d love to hear your stories, please do leave comments below.

*****

Discover more moving home articles on Safestore’s blog where you’ll find a range of topics; from homeowner advice to expat tips and more. Or, if you require storage during a move we have a range of self storage options in over 100 locations – find your nearest store for a quote today.